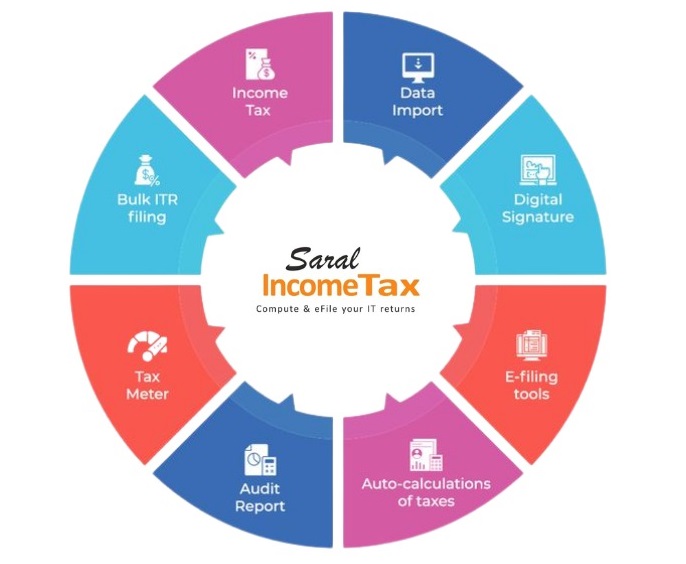

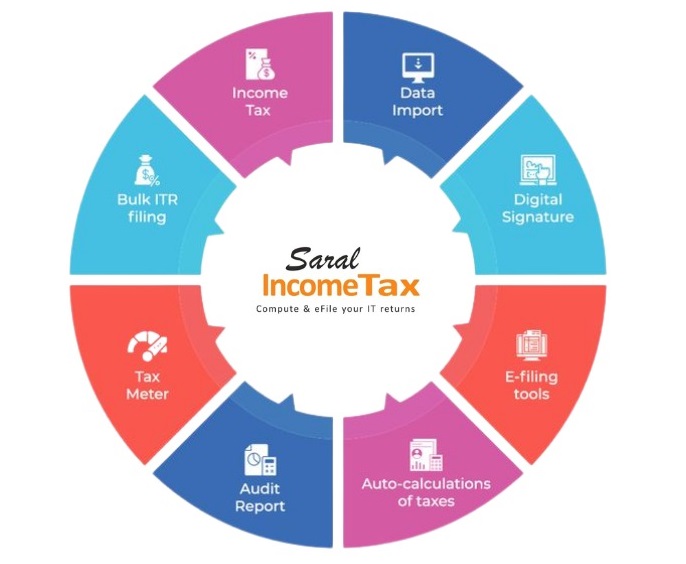

Saral ITR

Key Features:

• Bulk Upload of Income Tax Return

Prepare all the Income Tax Return and upload them to ITD website on one click through our ITD eReturn Intermediary module

• Integrated With Income Tax Department Website

All the options in ITD website i.e login, view details, verify information, know the status etc can be directly browsed through the software

• Auto E-Filling of Income Tax Return With Digital Signature

Income Tax Return can be filed with applying Digital Signature for the return

• Auto Computation of Tax

Auto computation of income and exceptions for all categories of Assessee with Advance Tax estimation

• Tax Meter

Tax Meter to have a quick glance incomes under different heads of income and tax and interest payables

• Data Import From Tally

The details required for Balance Sheet and Profit & Loss Account can be directly ported from TALLY

Saral GST

Key Features:

- Integrated with GSTN APIs for secure and seamless data transfer

- Comprehensive Dashboard giving a summary of filing status, Invoices & other GSTN alerts, OTP Management

- Simple and Convenient data entry flow, Import from Excel

- Fetches GSTR-1A, and GSTR-2A information

- Automatically Accept/Reject/Modify changes to Invoices

- GST computation and CGST/SGST/IGST wise Input Tax Credit distribution

- e-Payment and Input Tax Credit Utilization

Saral TDS

Saral TDS is a complete TDS management software built in the state of the art technology, complying with TDS/TCS prescribed as per the Income Tax Laws of India. Saral TDS is known for its stability and regular updates with ongoing changes in the TDS system.

The software is supported by a dedicated support system and time-to-time seminars/training across India. Since the year 2003, the software has been recognized across India by thousands of satisfied customers with more users adding day by day The users of the software include Chartered Accountants and Large Corporates. Ltd and Pvt Ltd Companies Nationalized Banks, TIN Facilitation centres, and many more.

Features

- Quarterly statements of TDS and TCS, with built-in FVU(File Validation Utility) tool

- Correction statements from data downloaded from TRACES(TDS Reconciliation Analysis and Correction Enabling System)

- In-Built Form15G/15H eReturn, Form 24G Monthly Returns

- Import/Export data from Excel/Text/FVU/TDS formats

- Consolidated Form16 - TRACES PartA with SaralTDS PartB

- Digitally sign & eMail TDS Certificates

- Threshold limit check for each transaction

- Automated Tax Calculation for Salaries and Non-Salaries

- Automated Prequisite calculation and other salary/Income-Tax calculations

- Vast MIS report for Deductions, Challans and various practical scenarios

Forms Covered

- TDS Returns: Form 24Q (Salary Payments), 26Q(Indian Resident Payments), 27Q (NRI Payments), Form 24G

- TCS Returns: Form 27EQ

- e-TCS/TDS Summary Return: Form 27 A

- TDS Certificates : Form 16 (Only Salary Income) , 16A (Other than Salary Income), 12BA(Perks)

- TCS Certificate : Form 27D

- Challans : ITNS 281

- ITR 1 (SAHAJ) form

- Form 15G/15H (Self Declaration form)

TRACES Integration

- Bulk PAN Verification

- Default Summary

- Validate Lower Deduction certificate under Section 197

- Request and download Consolidated File

- Bulk Form16/16A and Justification Report

Simplify Your Annual Report Filing with Saral XBRL

eXtensible Business Reporting Language (XBRL) is an open internet standard built on XML for the electronic communication of business and financial data.

Are you tired of spending hours on the conversion of your annual report to

XBRL format for filing with the Ministry of Corporate Affairs (MCA)?

Fret not, as Relyon has developed a software solution - Saral XBRL - that makes the entire process a breeze.

Saral XBRL boasts of several features that simplify the entire process of converting your annual report information to XBRL format. Let's take a closer look at some of its key features:

- Ease of Entry: Saral XBRL offers a single screen for data entry, making it easy and convenient for you to enter or import the necessary details. It also provides appropriate segments for fast and accurate data entry.

- Complete XBRL Taxonomy Flow: The software follows a complete XBRL taxonomy flow, ensuring that your annual report information is converted to XBRL format as per the required standards.

- Fully Linked Schedules and Sub-schedules: Saral XBRL avoids duplication of entries by providing fully linked schedules and sub-schedules. It also offers grid entry for share capital and fixed assets entries.

- Element-wise Notes: The software provides an option to capture element-wise notes in addition to general notes, enabling you to provide detailed explanations for each element.

- Validation during Data Entry: Saral XBRL offers validation during data entry, ensuring that the information entered is accurate and in compliance with the XBRL format.

- In-built Instance Documents Creation and Validation: The software allows you to create the instance document yourself and provides in-built validation to ensure that the document is error-free.

- In-built FAQs and Business Rules: Saral XBRL offers in-built FAQs and business rules, making it easy for you to understand the software and comply with the necessary regulations.

- Web Updates for Handling Changes: The software provides web updates to handle any changes in the XBRL format, ensuring that your annual report is always up-to-date and in compliance with the regulations.

- Software Security: Saral XBRL offers software security to ensure that your data is safe and secure.

- Backup and Restore: The software provides backup and restore features, enabling you to retrieve your data in case of any technical glitches.

With all these features, Saral XBRL is a full-fledged software that eliminates the need for macros or excel sheets. It provides a comprehensive solution to convert your annual report information to XBRL format with ease and accuracy.

In conclusion, Saral XBRL is an excellent software solution for simplifying the annual report filing process. Its user-friendly interface, validation during data entry, in-built instance documents creation and validation, and backup and restore features make it a reliable and convenient choice for businesses. So, switch to Saral XBRL today and make your annual report filing hassle-free!